Buying a house at auction might seem intimidating at first, especially if your only frame of reference is a fast-talking host on a property show hammering down final bids. But the real-world version is far less chaotic—though no less exciting. If done right, you could walk away with a great property below market value. That said, the process isn’t exactly like browsing a listing site and calling an agent. It requires a solid understanding of how auctions work, a bit of prep, and the right mindset. Let’s break it down into clear steps so you know exactly what to expect.

How to Buy a House at Auction

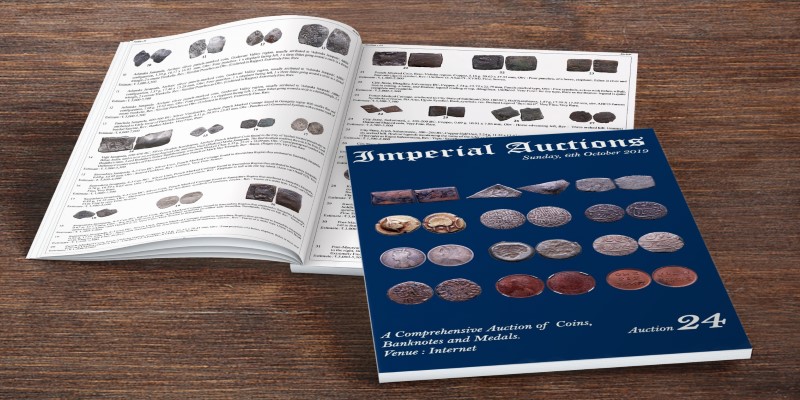

Step 1: Start With Auction Catalogs and Listings

Before anything else, you’ll need to know what’s up for sale. Property auction houses release catalogs—usually online—detailing what’s on offer in their upcoming events. These come with guide prices, descriptions, and basic legal notes.

Don’t assume the guide price reflects the final sale value. In fact, it’s often set deliberately low to draw in bidders. Still, it gives you a starting point.

Start flagging properties that match your budget and goals. Whether you're looking for a home, a rental investment, or a fixer-upper, be selective. You’re not just looking for any cheap property—you’re looking for the right one.

Step 2: Review the Legal Pack

Every property up for auction should come with a legal pack prepared by the seller’s solicitor. It typically includes:

- Title documents

- Property searches

- Leases (if applicable)

- Any special conditions of sale

This isn’t the kind of stuff you want to skim. Ideally, you’ll have a solicitor go over it with you before auction day. Even one buried clause can end up costing you thousands—or worse, make the property unusable for what you intended.

Some buyers skip this step, thinking it's optional. It's not. You're not just buying a house—you're accepting all the legal baggage that comes with it.

Step 3: Arrange a Viewing (And Be Thorough)

Auction homes are sold as-is, and that means no negotiating on condition after the fact. So, viewing the property in person is non-negotiable. Auction houses usually arrange open viewings, and if you miss them, you miss your shot.

During your visit, bring someone who knows what to look for—ideally a builder or surveyor. Check for dampness, subsidence, roof issues, or anything structural. These aren't the kind of surprises you want after the gavel falls.

Also, pay attention to the area. No matter how good the house looks, the neighborhood matters just as much. Is the street clean? Are homes occupied or boarded up? Are there any planning applications nearby that could impact property value?

Step 4: Sort Your Finances—In Advance

Here’s where auction buying differs massively from traditional routes: if you win, you pay a 10% deposit on the spot and usually have to settle the full amount within 28 days.

That means there's no time to "see if you can get a mortgage" after winning. You need to have funds lined up before you even walk into the room—or log in if it's an online auction.

There are three ways most buyers finance auction purchases:

- Cash – Simple, fast, and preferred.

- Bridging loan – Short-term finance that covers the purchase and repaid when you refinance or sell.

- Auction-specific mortgage – These exist, but approval needs to be secured before you bid.

Either way, do not place a bid unless you're 100% sure you can complete it within the auction house's timeframe.

Step 5: Set Your Maximum Bid (And Stick To It)

Bidding can be emotional. It’s easy to get caught up in the rush and go over your planned limit—especially when it feels like "just a few thousand more" will secure the deal.

Set a ceiling number before the auction begins. Write it down. Commit to it. If bidding passes that number, walk away. There will always be other opportunities.

Winning a bid that puts you under financial strain isn’t a victory—it’s a long-term problem. Discipline here is key.

Step 6: Bid Smart—Not Fast

When it comes to live bidding, people tend to think speed equals strength. But often, the smartest bidders are the quietest in the room.

You don’t need to jump in at the first bid. Let the early excitement settle and see how things progress. If the property is clearly heading over your budget, you’ll save time and stress by not engaging at all.

In online auctions, some bidders wait until the last few seconds to make a move. This is known as sniping, and while it's allowed in some formats, others extend the auction time after each last-minute bid. Know which format you’re in—and plan accordingly.

Step 7: If You Win, Move Fast

Once your bid is successful, the clock starts ticking. You’ll need to pay around 10% of the final price as deposit immediately and sign the sale contract.

From there, you’ll have about 20 to 28 days (check your auction house’s specific rules) to complete the purchase. That means transferring the remaining balance, settling all fees, and officially taking ownership.

If you miss that window, you risk losing your deposit—and possibly facing legal action from the seller.

So, have your solicitor and finance provider ready to act right away. The smoother your post-auction process, the sooner you can collect the keys and get moving.

Final Thoughts

Buying a house at auction isn't for everyone. It takes preparation, decisiveness, and a cool head under pressure. However, if you follow the steps above, you'll walk into the auction room (or log into the online platform) not with nerves but with confidence.

Just remember: do your homework, check the small print, and never bid beyond your means. That way, whether you win or walk away, you’ll have made the right call.